Income Tax Bill 2025, revised Income Tax Bill, Nirmala Sitharaman, Lok Sabha, updated tax bill, government tax policy

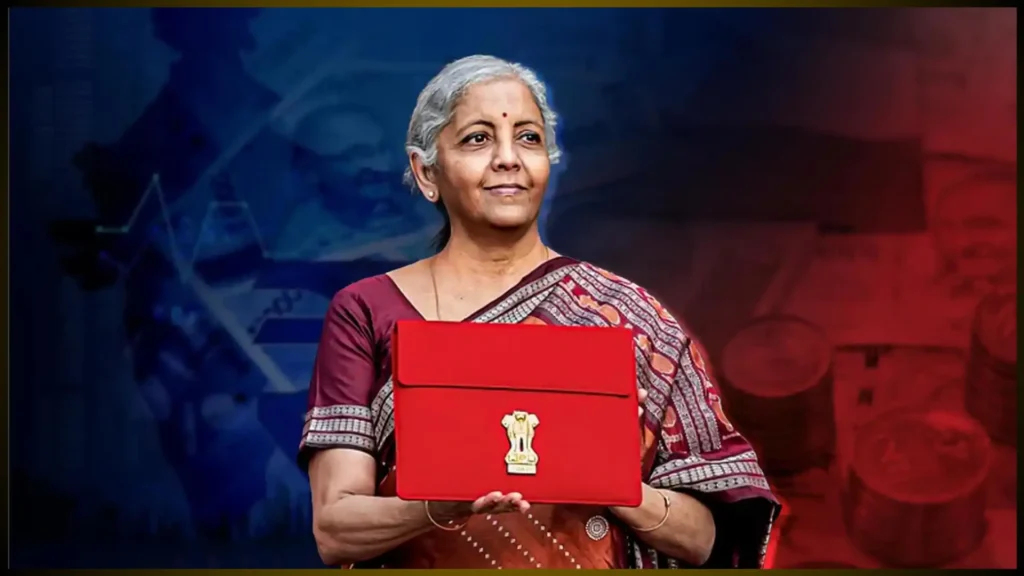

In a major move that could reshape India’s tax landscape, Union Finance Minister Nirmala Sitharaman on Monday introduced the revised Income Tax Bill 2025 in the Lok Sabha.

The updated bill aims to replace the six-decade-old Income Tax Act, 1961, bringing in fresh provisions and updated language to make tax laws clearer and more relevant to the current economy.

Why This Matters

The original draft of the Income Tax Bill 2025 was tabled earlier this year but faced criticism and calls for clarity from multiple quarters — including Members of Parliament, industry experts, and legal stakeholders.

To address these concerns, the government referred it to a 31-member Select Committee, chaired by BJP MP Baijayant Panda. This committee reviewed the bill in detail and submitted its recommendations.

What’s New in the Revised Bill

While presenting the fresh draft, Sitharaman confirmed that “almost all of the recommendations of the Select Committee have been accepted” by the government.

The revisions also include suggestions from industry stakeholders aimed at making the legal language more precise and reducing potential ambiguities in interpretation.

The Finance Minister called the revised legislation The Income-Tax (No. 2) Bill, 2025, stressing that it is designed to consolidate and amend tax laws for a more streamlined and transparent system.

Also Read This:

.SSC CGL 2025 Exam Postponed! Big Changes After Technical Glitches Hit Phase XIII Exams

PG Electroplast Stock Tanks 20% as FY26 Growth Guidance Slashed — Investors Lose Big

How We Got Here

Just three days earlier, on Friday, Sitharaman withdrew the original version of the bill during the ongoing Monsoon Session of Parliament. This was a rare move but signaled that the government wanted to get it right before making such a major change.

Parliamentary Affairs Minister Kiren Rijiju had already hinted at this development on Saturday, confirming that a modified version would be presented on August 11.

Rijiju also addressed speculation that this meant starting from scratch:

“It is being presumed that there will be an absolutely new bill, ignoring the earlier bill for which a lot of work was done… That’s not the case.”

The Role of the Select Committee

The Select Committee’s job was crucial. With members drawn from across party lines, it examined the bill clause by clause, taking inputs from tax experts, chartered accountants, and business associations.

Their suggestions ranged from clarifying definitions in the bill to simplifying compliance requirements for individuals and businesses. The government’s decision to adopt nearly all their recommendations signals a collaborative approach to lawmaking.

What Happens Next

With the revised Income Tax Bill now tabled, it will go through the usual legislative process in Parliament. If passed, it will mark the end of the Income Tax Act, 1961, a law that has governed how Indians pay taxes for over 64 years.

The bill’s implementation could potentially begin in the next financial year, giving both the government and taxpayers time to adjust to the changes.

Bottom Line

The revised Income Tax Bill 2025 is more than just a tweak to existing laws — it’s an attempt to modernize India’s tax system, reduce ambiguity, and make compliance easier.

By incorporating inputs from MPs, experts, and stakeholders, the government hopes this new framework will stand the test of time — just as the 1961 Act did for decades.

Sources:

About the Author

This article was written by Anwar Hashmi, who covers political and economic developments in India. For collaborations or story tips, contact at anwar@aavaz.in or connect via Facebook.